Washington State Excise Tax Increase

In a midnight maneuver, the Washington state legislature passed an amended bill that approves a graduated excise tax on property sales. If signed by the governor as expected, the changes will be effective January 1, 2020.

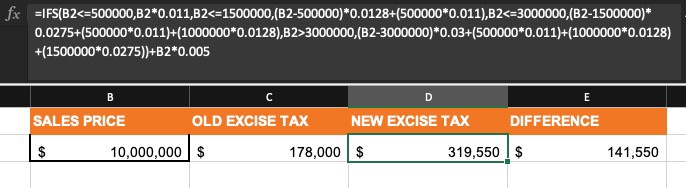

The Legislature changed the state REET rate for most sales of real property from a flat 1.28% of the selling price to a graduated rate structure, as follows:

- 1.1% of the selling price below $500,000;

- 1.28% of the selling price between $500,000 and $1,500,000;

- 2.75% of the selling price between $1,500,000 and $3,000,000; and

- 3.0% of the selling price over $3,000,000.

- Local REET rates (usually 0.5%) are then added to the state rate.

This is a significant change and will nearly double the excise tax due on the majority of investment sales. A $10 million sale will generate an additional $141,550 in tax. The calculation is somewhat tricky so we created a tax calculator that compares the current rates against the rate based on the new law coming into effect January 2020. Contact us for the file or use the formula in the image above.